Investing in the stock market can be an exciting and rewarding journey, but for beginners, it can also feel overwhelming and complex. However, with the right knowledge and a strategic approach, anyone can navigate the stock market and make informed investment decisions.

In this beginner’s guide, we will break down the key steps and provide essential tips to help you embark on your stock market investing journey with confidence. From understanding the basics to developing a solid investment strategy, read on to discover how to invest in the stock market and potentially grow your wealth over time.

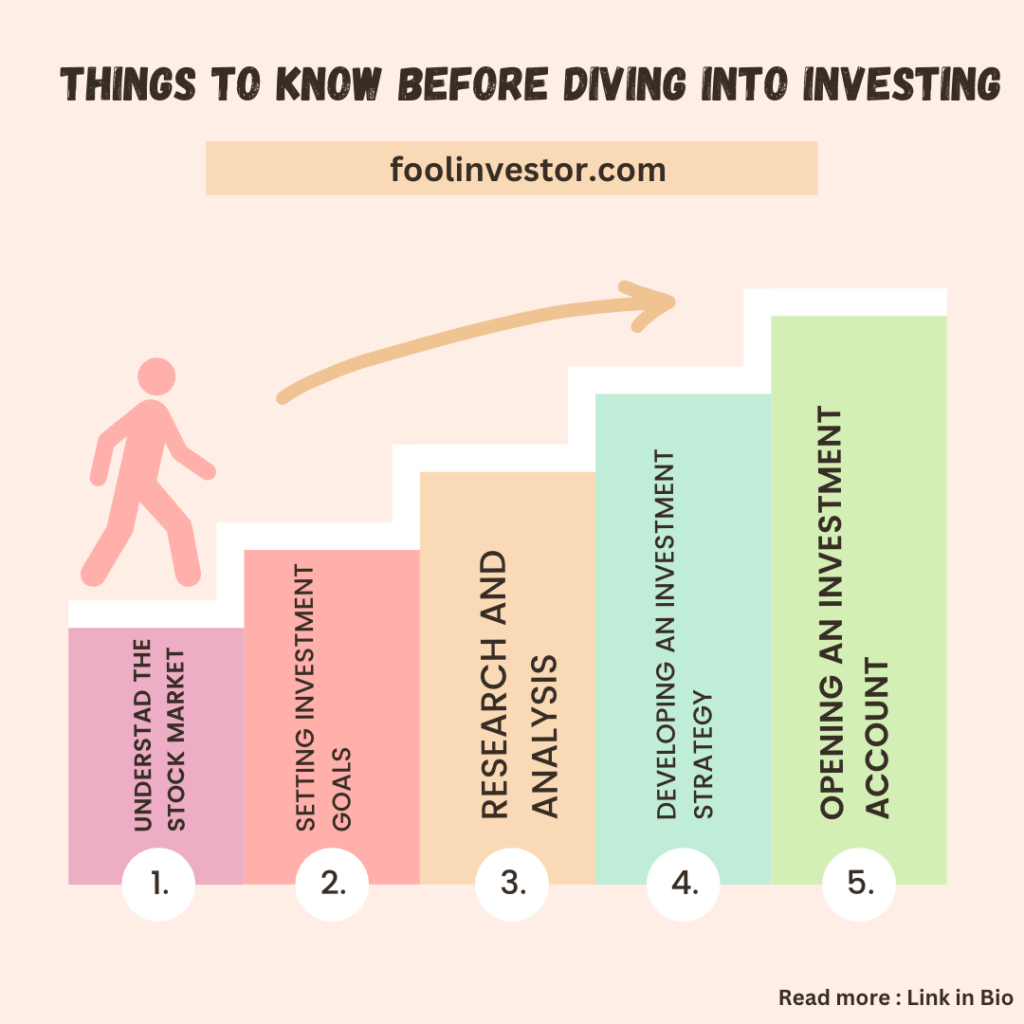

Things to Know Before diving into investing –

Understanding the Stock Market: Before diving into investing, it’s crucial to understand the stock market and its fundamental concepts. Learn about stocks, shares, exchanges, and the factors that influence stock prices. Gain insights into different investment options, such as individual stocks, exchange-traded funds (ETFs), dividend stocks, and mutual funds.

Setting Investment Goals and Risk Tolerance: Define your investment goals and determine your risk tolerance. Are you investing for retirement, education, or a specific financial milestone? Assess your comfort level with risk, as it will guide your investment strategy. Consider factors like your age, financial obligations, and long-term financial objectives.

Conducting Research and Analysis: Thorough research and analysis are essential before investing in any stock. Learn how to evaluate a company’s financial health, study its past performance, analyze industry trends, and assess future growth potential. Utilize online resources, financial statements, and news platforms to gather relevant information.

Developing an Investment Strategy: Crafting a solid investment strategy helps you stay focused and disciplined. Determine your asset allocation, which refers to the proportion of stocks, bonds, and other investments in your portfolio. Decide whether you want to pursue a passive or active investment approach. Consider diversifying your investments to spread risk and maximize potential returns.

Opening an Investment Account: To start investing in the stock market, you’ll need to open an investment account. Research different brokerage firms and choose one that suits your needs, considering factors like fees, available investment options, user interface, and customer support. Follow the account opening process and ensure compliance with legal and regulatory requirements.

Making Your First Investment: With your account set up, it’s time to make your first investment. Implement the investment strategy you developed earlier. Place your trades through your brokerage platform, considering factors like order types, pricing, and timing. Monitor your investments regularly and stay informed about market trends and news.

Reviewing and Adjusting Your Portfolio: Regularly review your portfolio’s performance and make adjustments as necessary. Reassess your investment goals, risk tolerance, and market conditions. Consider rebalancing your portfolio periodically to maintain your desired asset allocation.

Conclusion: Investing in the stock market can be a rewarding endeavor, but it requires knowledge, patience, and a long-term perspective. By understanding the fundamentals, setting clear goals, conducting thorough research, and developing a sound investment strategy, beginners can confidently navigate the stock market. Remember, investing involves risks, and it’s crucial to stay informed, adapt to changing market conditions, and seek professional advice when needed. Begin your stock market investing journey today and potentially unlock opportunities for long-term financial growth.